Segregated Funds

- PPI

- Apr 22

- 1 min read

A segregated fund is a deferred annuity contract offered by a life insurance company that combines the growth potential of a mutual fund with the security of a life insurance policy. The segregated fund contract is a life insurance contract between the policyholder and the insurance company. The annuitant under the contract is the person upon whose life the contract is based. In most cases, upon death of the annuitant, the policy terminates and any death benefit guarantee becomes payable to the beneficiary designated for the contract. Segregated funds are a good option for those approaching or in retirement or business owners who like the security of guarantees and potential creditor protection.

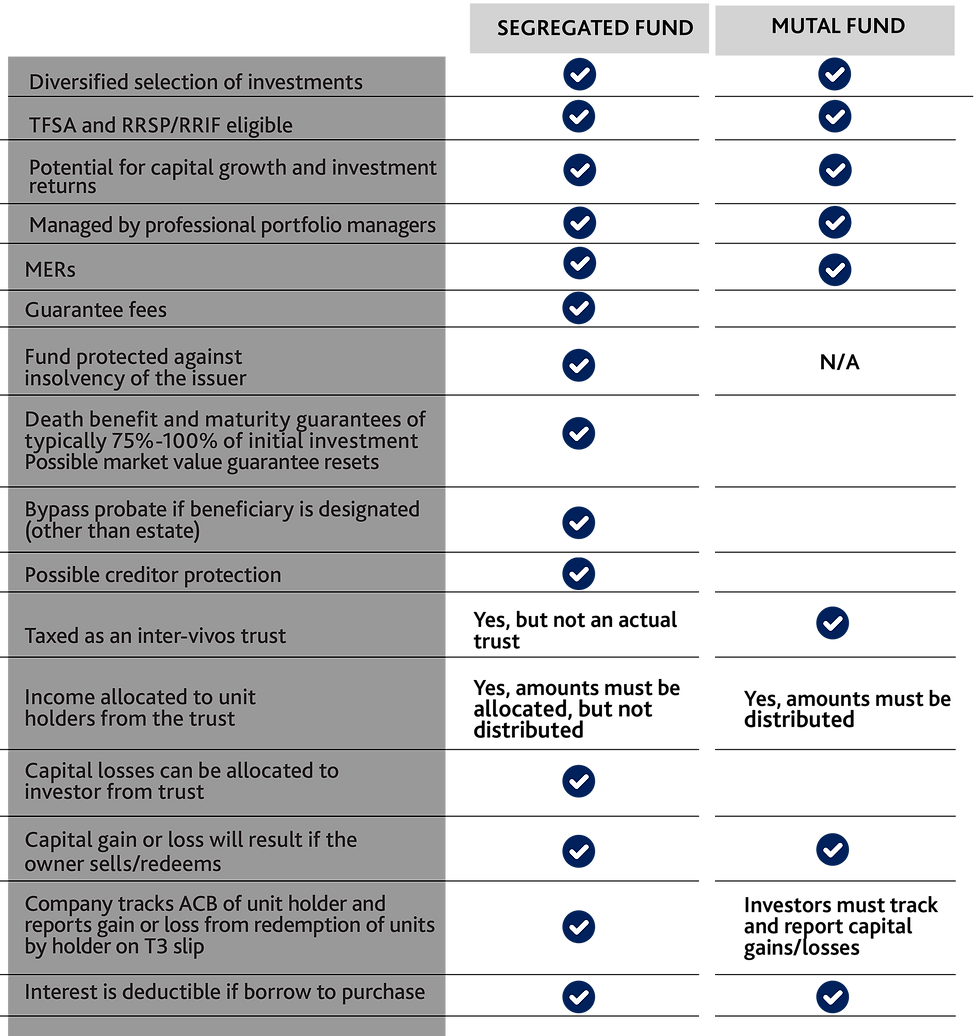

The following is a comparison of segregated funds and mutual funds: